The National Real Estate Post recently posted this interesting comparison of iBuyers and real estate agents.

As most of you know, iBuyers are large firms that buy homes from sellers outright so sellers don’t have to go to the trouble of listing and showing their homes.

The iBuyers then resell the properties as quickly as possible and usually for a profit. Some of the major iBuyers include Opendoor, Offerpad, and Zillow.

iBUYER FEES ARE HIGHER THAN REALTOR COMMISSIONS

The video’s host points out that the iBuyers charge large “fees” that are really no different than commissions. What is surprising though is that the iBuyers’ fees add up to more than the average commission rate charged by real estate agents.

Opendoor and Offerpad charge fees that total 7.5% of the purchase price, while Zillow charges fees that total 7%. The fees for Opendoor, for example, include such line items as an “Experience Charge” and Repairs, and even a “Market Risk” fee.

The average real estate commission paid by sellers is now just over 5%, according to the host, so sellers are paying substantially higher fees to the iBuyers.

In addition, the iBuyers are unlikely to offer top dollar, given their desire to resell the homes at a profit.

The hosts also cite this WSJ article that discusses iBuyers at length as “The Future of Housing.” The WSJ article points how much traction iBuyers are getting in cities like Phoenix where there are large tracts of similar houses (something iBuyer algorithms require).

The article also mentions a couple in AZ who sold their home for $215,000 only to watch Opendoor quickly resell the home for $240,000 after painting and slapping in some new floor coverings (something any agent would have recommended from the get-go).

So, the sellers effectively left $30,000+ or more on the table by going the iBuyer route.

In any case, there is a lot of data that agents can readily use to convince sellers not to sell to an iBuyer. And I suspect the iBuyer model will become much less viable if and when real estate takes a downturn and homes end up sitting on the market.

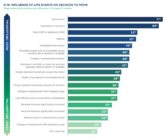

BUT, the biggest takeaway from all or this is that sellers are obviously willing to leave a lot of money on the table simply to avoid friction.

Friction Avoidance needs to be something we all focus on to win and keep clients.

Jay Voorhees

Founder/Broker | JVM Lending

(855) 855-4491 | DRE# 01524255, NMLS# 310167