You are less than 60 seconds away from your quote.

Resume from where you left off. No obligations.

First-time buyers can now get rates up to 1% LOWER permanently with JVM's Rate Discount Program.

The journey towards owning your first home just became much more affordable with some massive loan guideline changes. In a refreshing move towards affordability, the two largest mortgage entities, Fannie Mae and Freddie Mac, have ushered in huge rate discounts for first-time home buyers.

Here at JVM, we are ready to make sure you can take full advantage of these impactful rate discounts.

From a technical standpoint, the rate discounts are achieved by eliminating fees known as Loan Level Price Adjustments (LLPAs) from a qualified first-time homebuyer’s rate. But how does this change the game for aspiring homeowners? Let’s dive deeper into this program and we will help shed light on how you can qualify for JVM’s Rate Discount Program to have your LLPAs waived and save significantly on your first home purchase.

There are 14 factors that impact your mortgage rate and each factor carries an associated fee that adjusts the price of your loan rate up or down. Hence, the term “loan level pricing adjustment”, or LLPA.

This is because mortgage interest rates are determined by “risk-based pricing”. When there are factors present that increase a borrower’s risk of defaulting on a loan, such as low credit scores, investors demand higher interest rates to compensate them for that risk.

Investors, like Fannie Mae and Freddie Mac, use LLPAs as a standard way to calculate how much someone’s rate will increase for each risk factor present. These LLPAs quickly add up and can make an aspiring homeowner’s rate and payment far too high to manage.

Therefore, having these LLPAs waived through JVM’s Rate Discount Program gives first-time buyers a much-needed leg up. Today, a qualified first-time buyer with a credit score of 640 and a low down payment of 3% can enjoy the same interest rate as a seasoned buyer with a credit score of 780 and a 25% down payment.

Fannie Mae is a name that comes from the acronym FNMA, which stands for the Federal National Mortgage Association. Freddie Mac is a name that comes from the acronym FHLMC, which stands for the Federal Home Loan Mortgage Corporation. FNMA and FHLMC are private companies that are government-sponsored enterprises (GSEs) in the United States.

Fannie Mae and Freddie Mac operate as the largest investors in the secondary mortgage market, purchasing roughly 70% of all mortgages in the United States. This adds liquidity and stability to the mortgage market because it lowers the costs and risks for lenders, and makes homeownership more affordable and accessible to consumers.

Because of their massive role in the secondary markets, these companies essentially set the rules for who can qualify for mortgage financing. And, when they make a change like eliminating LLPAs for qualified first-time homebuyers, JVM is ready to pass along those huge rate discounts.

The journey to obtaining JVM’s Rate Discount begins with understanding the eligibility criteria:

AND earn either:

The impact of having your LLPAs waived through JVM’s Rate Discount will vary based on your loan specifics. Those with lower credit scores and smaller down payments stand to save more since their rates would have been higher, to begin with. Through a few examples, let’s illustrate the potential savings awaiting first-time home buyers.

The below examples all assume a $500,000 loan amount and a base interest rate of 7%.

Without JVM’s Rate Discount:

With JVM’s Rate Discount:

Savings:

Without JVM’s Rate Discount:

With JVM’s Rate Discount:

Savings:

Without JVM’s Rate Discount:

With JVM’s Rate Discount:

Savings:

In each scenario, JVM’s Rate Discount continues to provide considerable savings either upfront or over the long term with a lower monthly mortgage payment. This showcases its financial advantage for first-time home buyers.

*The scenarios provided above are highly simplified and are intended for illustrative purposes only. They do not take into account all possible fees, charges, or other financial variables that may affect the actual costs associated with obtaining a mortgage. Consult with a mortgage professional at JVM Lending to obtain precise and personalized advice based on your individual circumstances and financial position.

Knowing the income eligibility for your desired area ahead of time can significantly influence where you direct your search. The maximum qualifying income varies by county, but Fannie Mae facilitates looking this up by providing a tool to check the median income of your area. Remember, look at the Area Median Income in the city in which you want to purchase, not the city in which you currently live.

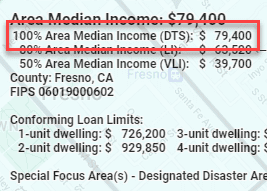

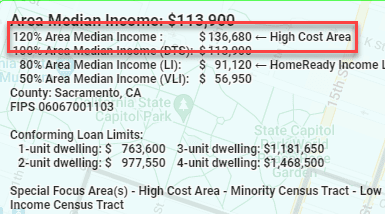

Always use the highest % Area Median Income returned on the website for the city in which you desire to purchase. The website will only return 100% Area Median Incomes for non-high-cost areas, and it will return 120% Area Median Incomes for high-cost areas. For example:

Non-high-cost area:

High-cost area:

Determining your qualifying income, used by lenders for the waiver, can be a bit complex for self-employed, hourly, seasonal, or gig workers. And, while it is far more straightforward to calculate for salaried, W2 employees, there are still adjustments made for bonuses or other discretionary income.

At JVM Lending, we are experts at calculating income and can assist with reviewing your income documentation to provide clarity on this front.

Don’t stress too much if you don’t meet the eligibility requirements, as we offer several first-time buyer programs that offer low down payments and share some of the same advantages as the LLPA waiver loans.

Once you meet the requisites, the LLPA waiver is automatically applied. The mortgage experts at JVM Lending are extremely experienced with offering Fannie Mae or Freddie Mac loans and can guide you through the process.

Please note that FHA, VA, or USDA home loans do not qualify for this waiver as they don’t employ LLPAs for fees or rates determination. The LLPA fees are specific to Fannie Mae and Freddie Mac conforming loans.

The JVM Rate Discount program covers all aspects that can impact a rate, making it one of the most beneficial programs available to first-time home buyers. Other programs are less generous and thorough. The waiver encompasses various property types and extends beyond the conventional boundaries of down payment and credit score.

While there is no expiration date for the JVM Rate Discount, future market conditions and guideline changes might influence this provision. In today’s ever-changing market, we advise all our clients to move swiftly once they set out on the path to buy a home to ensure they don’t miss their opportunity.

This program opens up a realm of possibilities by waiving LLPAs for moderate-income first-time home buyers, aligning with Fannie Mae’s mission of making homeownership attainable. With lower rates and fees on the horizon, now might be the opportune moment to reignite your home buying aspirations.

Our team at JVM Lending is here to guide you every step of the way. Start your JVM loan application online or contact us today to discuss your homeownership goals and learn more about how JVM’s First-Time Buyer Discount Program could be the key to unlocking your dream home.

Resume from where you left off. No obligations.