Understanding Non-Warrantable Condos

For a condo to be deemed “warrantable,” it needs to meet a comprehensive list of requirements specified by conventional lenders. We’ll delve into some of these factors under “12 Key Factors When Buying a Condo.” Understanding these requirements is vital for both prospective condo buyers and real estate agents, as they significantly impact property values and the availability of financing options.

Potential pitfalls await condo buyers when they commit to a contract for non-warrantable condos. These buyers might either be unaware of the non-warrantable status or the consequences it carries, potentially affecting their financing options and property value.

Financing Options for Non-Warrantable Condos

As for financing non-warrantable condos, several options are available. However, it’s crucial to note that none of these alternatives are as beneficial as conventional financing.

Non-QM Lenders

One avenue for financing non-warrantable condos is Non-QM lenders, a safer, modern version of “subprime lending.” However, they require substantial down payments (20% to 25%, depending on the severity of issues and the borrower’s creditworthiness) and charge interest rates 2% to 4% higher than standard conventional rates. In certain cases, creditworthy borrowers and condos with minor issues may have options to lower the down payment to 10%.

Local and Regional Banks

Another option is local and regional banks, offering financing for non-warrantable condos. They too demand large down payments (often around 25%) and generally only provide adjustable-rate mortgages (such as 7-year ARMs). However, their interest rates tend to align more closely with standard conventional rates.

The Challenge for Buyers with Limited Down Payment

Buyers with limited down payment funds (below 20%) are most vulnerable when trying to purchase non-warrantable condos, given their limited options. Unless the condo’s issues are minor and the buyer has robust credit and income, securing financing could pose challenges.

For instance, we recently attempted to assist a buyer who could only afford a 10% down payment but was seeking financing for a non-warrantable condo. Sadly, the condo didn’t meet the “50% sold or pre-sold” requirement, rendering the buyer ineligible for any type of 10% down financing.

With Rate Watch, we’ll notify you via email when rates drop below your current rate.Get notified when rates drop!

12 Key Factors When Buying a Condo

Before purchasing a condo, there are 11 critical factors that both potential buyers and real estate agents should consider. These factors range from rules on unit concentration and commercial use to HOA delinquencies, litigation issues, and even the condo’s zoning.

Unit Ownership Limitations

A single person or entity is not permitted to own more than 20% of the total units in the condo complex. This limit was 10% before 2018.

Commercial Space Proportion

The maximum percentage of commercial space allowed within the entire complex is capped at 35%. This limit was 25% until 2018.

Occupancy Criteria

The occupancy of the condo by the owner is irrelevant if the buyer intends to occupy the unit. However, for investment buyers, the owner-occupancy ratio must exceed 50%.

Interest Rate Considerations

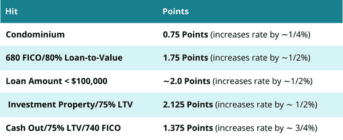

The interest rates for condo financing tend to be higher if the loan-to-value ratio exceeds 75%.

HOA Arrears

A maximum of 15% of the units are permitted to have HOA dues outstanding for over 60 days. This issue often surfaces during real estate downturns, such as those from 2009 to 2012.

Legal Concerns

Legal proceedings involving the Homeowners Association can potentially halt a deal unless they are minor or don’t impact the specific unit. A careful review of the litigation details is necessary. Non-Fannie Mae or non-QM lenders might be an option in such situations, though this could mean higher interest rates and down payment requirements.

Structural Issues

The HOA cannot have any ongoing structural issues. These would be referenced in meeting minutes or a special assessment.

Compliance with FHA/VA

A condo complex needs to be approved by the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA) for a buyer to secure FHA or VA financing. You can find FHA’s list of approved complexes here, and you can find VA’s list here.

Down Payment Options

For condo loans up to $726,200, there’s a 3% down payment financing option, which can be an excellent alternative to FHA loans, albeit with stricter guidelines. For “High Balance” loans ($726,200 to $1,089,300), a minimum down payment of 5% is necessary.

Determining Condo or PUD

Identifying whether a unit is a condo or a Planned Unit Development (PUD) requires more than a visual inspection. It’s essential to verify the zoning. If a unit doesn’t touch the ground, it’s likely a condo. If it does, it could either be a PUD or a condo. PUDs aren’t subject to condo restrictions.

HOA Fee Assessment

Lenders need to know the exact Homeowners Association dues as they have significantly increased over time and considerably impact the qualification process.

Requirement of Pre-Sold or Sold Units

For new condo developments, a minimum of 50% of the units within the project or specific phase must be either sold or under contract. The buyers should be either owner-occupants or second-home buyers, and not investors.

Conclusion

By understanding these 11 crucial factors, condo buyers can ensure they’re making an informed decision that takes into account their long-term financial obligations and potential return on investment.

Ready for more insights on condo buying and financing? Connect with JVM Lending today, and let our expertise guide your journey.