Don’t Waive Contingencies For Condo Purchases

We sometimes have very strong buyers waive contingencies when they make offers on condos.

But, no matter how strong a buyer might be from a credit, asset, and income perspective, deals can still readily die if the condo or the Homeowners’ Associations don’t pass muster.

For example, litigation, too much commercial use, ownership concentrations, and HOA issues can render condos “non-financeable” in the eyes of most lenders.

We encourage agents and buyers to review our “12 Condo Considerations” set out below.

12 Condo Considerations

Below are twelve things buyers and agents should consider if they plan to finance the purchase of a condo.

We remind our clients of these items from time to time because they are so important.

- Concentration Rule. No single entity/person can own over 20% of the units in the complex. Prior to 2018, it was 10%.

- Commercial Use. No more than 35% of the square footage of the entire complex can be “commercial.” Prior to 2018, the limit was 25%.

- Investment Properties Subject To “Limited Review.” This is new too, as investment condos formerly required “Full Reviews.”

(Limited Review means only the condo’s insurance policy is required along with basic HOA info) - Owner Occupancy Ratios. Owner Occupancy is irrelevant if a buyer intends to occupy the unit. It must be over 50%, however, if the buyer is an investor.

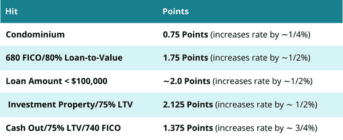

- Rates Are Higher. Condo financing has higher interest rates if the LTV is over 75%.

- HOA Delinquencies. No more than 15% of the units can be more than 60 days delinquent with HOA dues. This is rarely an issue these days, but it often surfaces during real estate downturns (it was a common issue from 2009 – 2012, for example).

- Litigation. Litigation involving the HOA is usually a deal-killer, but not always if it is minor or doesn’t affect the subject unit. We need to review the actual litigation/complaint. We can also use a non-Fannie or non-QM lender, but the interest rate and down payment requirement will both be higher.

- FHA/VA Approval. Entire condo complexes need to be FHA or VA approved before FHA or VA financing can be used to finance a unit, in most cases. You can find FHA’s list of approved complexes here, and you can find VA’s list here.

- 3% Down. This is a reminder that we offer 3% down financing for condos up to loan amounts of $647,200. This is a great alternative to FHA financing but guidelines are much stricter. For “High Balance” loans (from $647,200 to $970,800), the minimum down payment is 5%.

- Is It A Condo Or A PUD? This is a reminder that you can’t tell simply by looking at a unit. You need to check the zoning. If the unit does not touch the ground it is very likely a condo. But if it does touch the ground, it could either be a PUD/townhome or a condo. PUD/townhomes are not subject to any of the condo restrictions.

- HOA Dues. Lenders need to know exactly what they are because they are much higher nowadays than in the past and they significantly affect qualifications.

- Two To Four Unit Complexes No Longer Require “Project Reviews.” This is a relatively new change and it just means that it is much easier to get financing for small complexes now.

Sign up to receive our blog daily