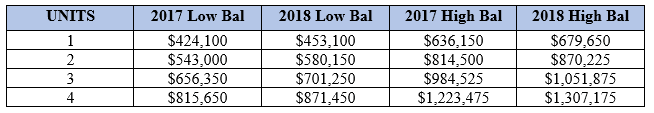

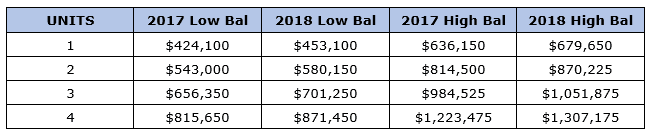

The “Low Balance” limit for a one-unit property jumped from $424,100 to $453,100. And the “High Balance” limit (for “High Cost” counties comprising most of coastal California) jumped from $636,150 to $679,650.

The limits for two, three and four unit properties also jumped, with the four unit “High Balance” limit now exceeding $1.3 million. All the limits along with comparisons to 2017 are set out below.

This allows for more borrowers to take advantage of conforming loan guidelines when buying properties in areas with increasing home prices. “Conforming” once again refers to loans that conform to Fannie and Freddie guidelines.

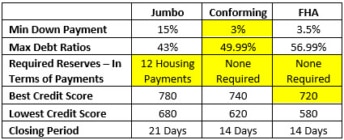

The advantages of conforming loans over “jumbo loans” include: (1) lower rates in most cases; (2) much lower down payment options; (3) less stringent underwriting guidelines; and (4) much faster closing periods.

Conforming loan increases are good for everyone except for my Grandma in Hitchcock, South Dakota (population 91)… where the average home price is about $25,000.

Quick side-story: When my Grandma moved from her farm house to her downtown “high-rise” (a one-story senior living complex), there were no buyers for her farm home even though it was in perfect condition. So, it just sat empty until a farmer tore it down and planted corn; the epitome of a soft market.

Anyway, my broader point is that while loan limit increases appear to be good for everyone, there is a cost b/c Fannie and Freddie are backed and subsidized by the Federal Gov’t. And these costs are born by everyone, including Grandmas in South Dakota who don’t benefit in any way from higher loan limits.

Final note: My Grandma is totally cool with the Fannie and Freddie subsidies as long as we keep subsidizing her new Tesla Roadsters :).

Jay Voorhees

Founder/Broker | JVM Lending

(855) 855-4491 | DRE# 1197176, NMLS# 310167