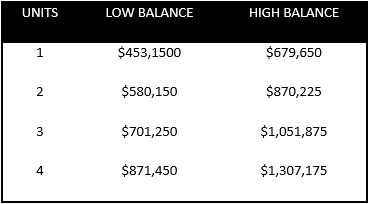

This is a reminder that Conforming and FHA Loan Limits are up for 2018.

$5.4 TRILLION OF HOME EQUITY

A recent article in The National Mortgage News reported that there was $5.4 trillion in home equity in the U.S. in 2017.

$3 Trillion of that was gained over the last five years – another reminder of the benefits of owning a home.

Prior to 2008, when home equity surged, most everyone used their homes as giant ATMs and borrowed against them…and it didn’t go well :).

We aren’t seeing the same thing take place now both b/c borrowers are more responsible and b/c underwriting guidelines are much stricter.

HELOC vs. CASH OUT MORTGAGE

For borrowers who do want to tap into home equity, the question becomes: Is it better to get Home Equity Line (HELOC) or a Cash Out Mortgage?

HELOCs have two disadvantages: (1) The interest is no longer tax deductible; and (2) HELOC interest rates are adjustable, tied to Prime Rate and climbing.

Prime Rate was only 3.25% for about six years after the meltdown. But, it recently climbed to 4.5% after the Fed increased the Fed Funds rate.

B/c HELOC interest rates are usually Prime Rate plus a “margin,” HELOC rates are now as high as 6.5% or more, depending on the combined loan-to-value ratio.

Interest rates for a “no cost” cash out mortgage are now in the low 4’s, for most conforming loan amounts.

If you have a fixed rate in the 3’s currently, and you do not need a large amount of cash, we recommend a HELOC still, despite the disadvantages.

If you need a large amount of cash (over $100,000 for example) that you will not be able to pay back in the foreseeable future, a cash-out mortgage may be a better option.

Jay Voorhees

Founder/Broker | JVM Lending

(855) 855-4491 | DRE# 1197176, NMLS# 310167